The financial services industry is currently flooded with debates about the opportunities and risks of mobile payments and the future of the retail banking sector – but the future is already here, it’s just yet to be fully embraced.

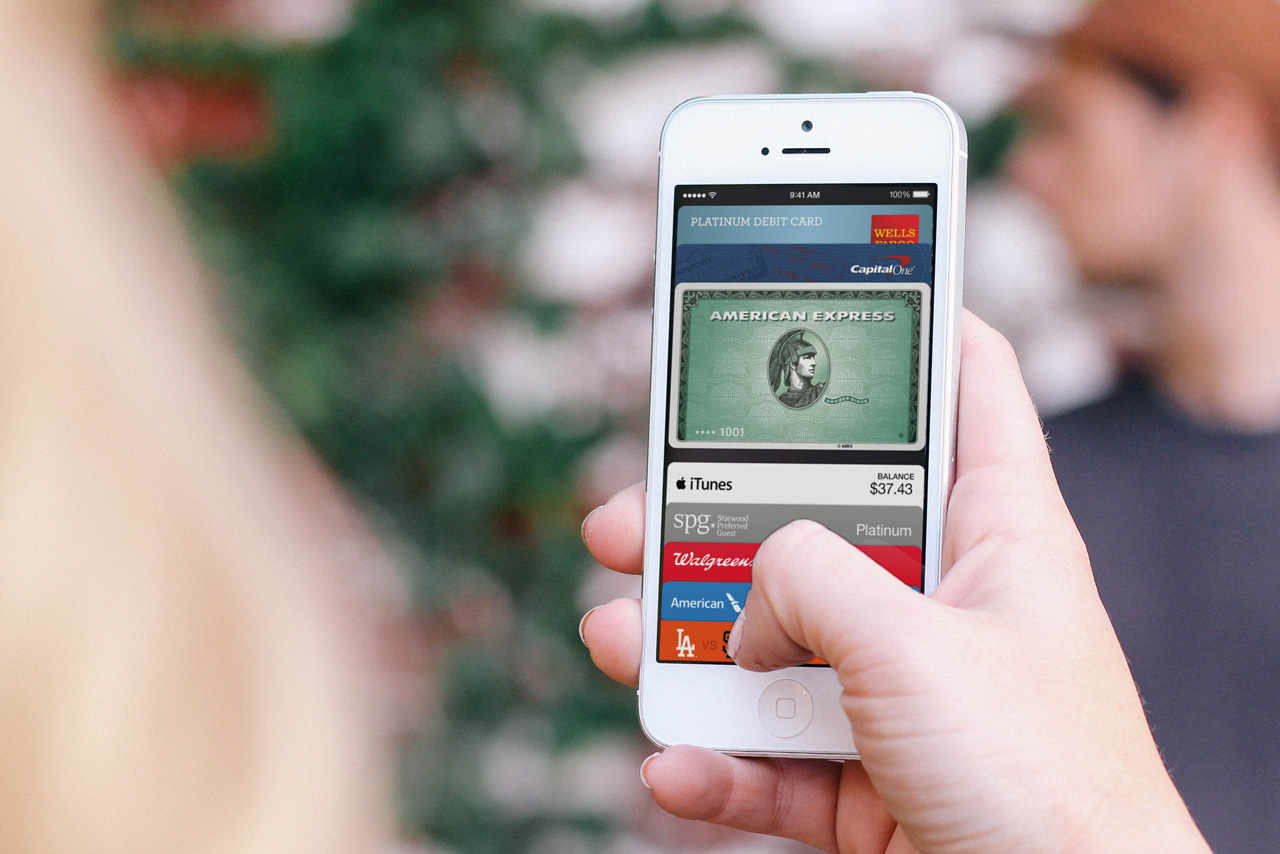

Most major banks already offer Paym mobile service payment and Barclays Pingit has, personally speaking, revolutionized the way I manage my finances. With Apple Pay and Google Wallet about to launch full services in the UK it’s not a case of whether mobile payments are ‘the next big thing’, but rather how the UK Retail Banking sector can adapt to be part of these new technology developments.

Mobile payments is already a fractured marketplace and is set to become even more splintered, despite the entrance of single propositions such as those from Apple and Samsung. It’s unlikely that, in the very near future at least, there will be a one-size-fits-all app that services every type of consumer and every one of their banking needs in ‘real time’. Consumers are unlikely to afford singular loyalty to one or even a few apps; their engagement will depend on their appetite for such technology and their specific needs. This is especially true considering 2 out of 3 adults in the UK don’t use a banking app – let alone partake in mobile payments.

Especially important is the simplicity of the app experience, how engaging it is, and how consumers view the security of the service. For many transactions, the banking infrastructure is the same whether using a mobile payment app or whether visiting a branch – the only thing that differs is the point of interaction. Think about this in terms of how we now engage with music – from CD to MP3 – the vehicle has evolved though the consumption remains the same. This is a key point that Retail Banks would be advised to embrace.

In order for Retail Banks to retain transactions they need to engage with and educate their customers on the use value of mobile banking – to offer a seamless service to match the offerings of technology giants such as Apple and Google. Or, as the old saying goes, if you can’t beat them – join them. There’s enormous potential for Retail Banks to extend their offerings by working together with tech companies – improving the service they offer to existing customers while thinking innovatively about how to attract new ones. They should also strongly consider engaging with the next generation, a demographic currently hugely underserved.

For example, you must be aged 16 or over to register for Barclays Mobile and Online Banking. Despite technology existing to be able to serve those under 16 to offer appropriate banking services, little has been done to engage with this demographic – key clients for the sector as the next generation of customers. While acknowledging the drive over the last two decades to engage with young adults as they head off to University, attractive incentives including free rail cards and large interest free overdrafts, Retail Banks may be missing a trick by not engaging with consumers one step earlier. Yes, the young can be fickle – but if a mobile banking app was as simple to use, as quick to provide results and as intuitive as some of Apple’s products, perhaps Retail Banks could begin to match Apple’s customer retention rates of over 76%.

The responsibility of Retail Banks should be one of proactivity and adaptability – to evolve their mobile banking service to be able to work for customers as an individual, personalised platform. That’s not to say that every retail banking service would be most effective on a digital platform – take first time mortgage applications for example. Some view mobile banking as impersonal and prefer to visit a branch to carry out their transactions, but imagine how personable mobile banking could be if it was flexible enough to suit your individual needs – allowing people the freedom to, for example, set their own daily transaction limits.

There’s huge scope for Retail Banks to embrace mobile payments in order to both retain customer loyalty and attract the next generation – whether this gauntlet will be taken up remains to be seen.